Set Spending Limits for the Holidays

Limit what you buy to what can safely come out of your bank account to give your credit card and your mind a break. Make use of this opportunity to develop or improve your budget, as well as to determine how much money you can afford to spend.

Holiday budgeting allows you to set spending restrictions while still enjoying the season. It can assist you in creating a budget and setting limitations that you will adhere to—without giving in and racking up debt.

Be Honest with Yourself about your Financial Situation

Your older brother has been paying off his college loans for the past five years, and he always buys you the most expensive gifts. If you are in a different financial situation, though, you should not follow suit.

If you're unsure whether the less expensive gifts you buy will be appreciated by folks on your list, consider what your friends and relatives bought you when their budgets were tighter. There's little question that if you don't put each other in debt this year, you'll be better friends in the new year.

Improve Your Spending Habits

Give yourself the gift of creating new and improved spending habits to get rid of the how-am-I-going-to-pay-off-my-credit-cards-next-month anxiety.

For example, you may discover a mechanism to deduct a dollar from your regular spending for every dollar spent on presents. You can use those savings to buy gifts for the holidays, but what you save next month—and the rest of the year—may go into your savings account.

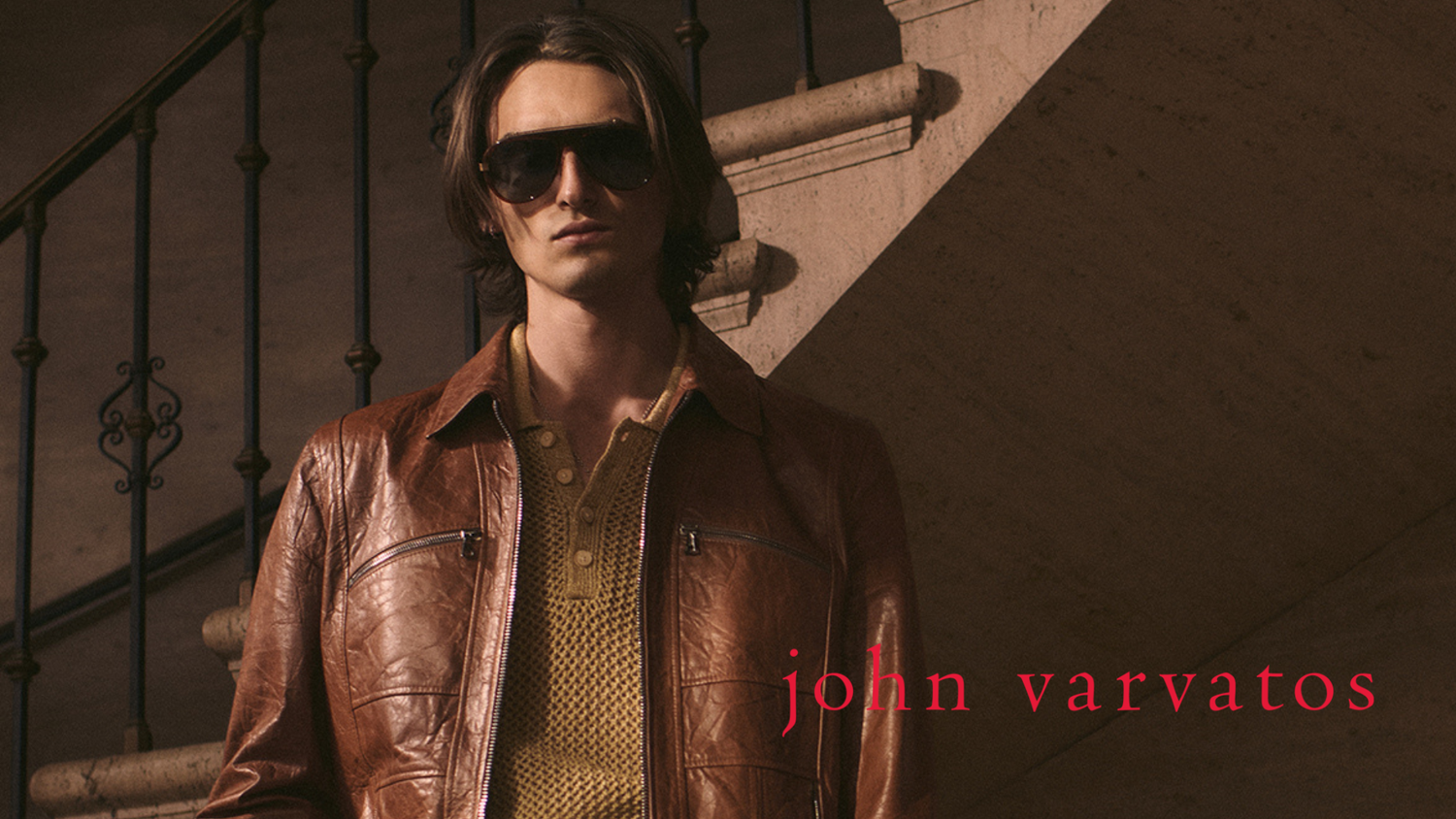

Don't let your debt turn into the Grinch who steals the joy of the holidays. Avoid giving yourself a year-round debt headache by selecting gifts based on sentiment rather than the dollar value. We at Ottika have the perfect gifting items for you. With our holiday season discount, you can surely be within your budget.

If you follow these suggestions, you'll be singing "Joy to the World" all over again when your Christmas bank and credit card statements arrive in the New Year.